[Video] Should I Have Multiple Credit Cards?

There's not a one-size-fits-all solution for the number of credit cards a person should have. In this video, we’ll help you better understand credit cards.

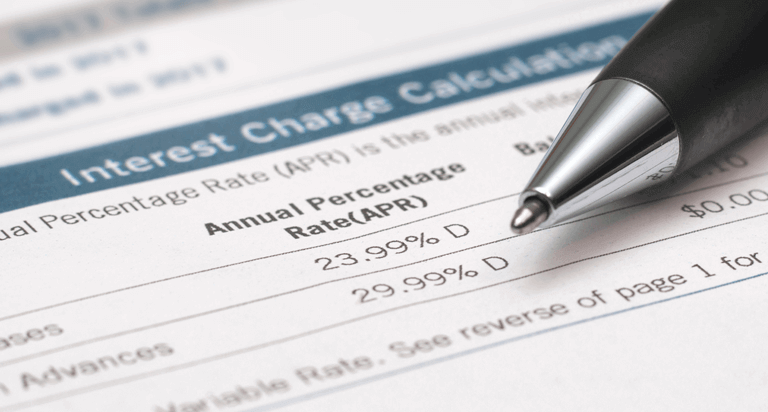

When it comes to considering the best credit card deals for you, you should consider the account terms, such as interest rates, and if there are any credit card perks that could benefit you and your lifestyle. Find more information about credit card interest rates, whether or not you should pay off a credit card balance, and how using a credit card impacts your credit scores. Also, learn how you could build and improve credit with credit cards.

There's not a one-size-fits-all solution for the number of credit cards a person should have. In this video, we’ll help you better understand credit cards.

Chargebacks allow consumers to dispute unauthorized charges on their debit or credit cards. Learn what chargebacks are and how they work.

A virtual credit card can provide an extra layer of security when shopping online. Learn about the pros and cons of virtual credit cards.

What is APR? APR is an important element of several types of credit. Learn more about APR and how it compares to APY.

Credit cards can be reliable tools for building a credit history or improving your credit scores. Here’s what you need to know about this popular strategy for building credit.

Is it better to increase the credit limit on your existing credit card or open a new credit account instead? Learn the pros and cons of each option.

Here are some common ways thieves target your credit card information — plus, steps you can take to help prevent credit card fraud in the first place.

Learn how cash-out mortgage refinancing can help you take the first step toward tackling your credit card debt.

Balance transfer credit cards are one common solution for managing high-interest debt. Could a balance transfer credit card be right for you?

Your credit card’s APR represents the annual cost of borrowing money, including interest and fees. Learn more about this important number.

Credit card statements can be key to developing and maintaining good borrowing habits. But what’s included on a credit card statement and how do you accurately read one?

Here are some common reasons people have credit card debt. Plus, learn how to avoid credit card debt and develop debt management strategies.