Alternative Data Sheds Light on Credit Invisibles

Alternative Data Sheds Light on Credit Invisibles

Lenders have historically used credit data to score consumers. But the problem with this approach is that it prevents lenders from seeing “credit invisibles,” those consumers who work, pay utility bills or rely on specialty funding – but don’t use credit. The number of in the U.S. stands at a staggering 25 million people.

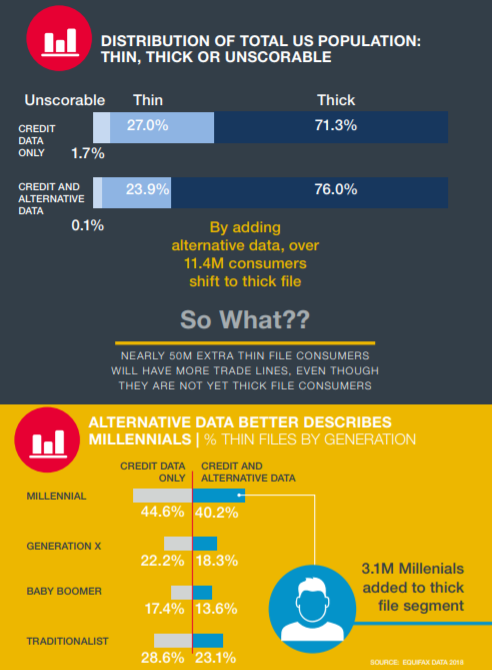

However, there is a way around this information imbalance that often exists between lenders and consumers. At the ������ϲ����� Spark conference in April, I explained how alternative data can reduce this information imbalance. Currently, the U.S. traditional credit database classifies:

- 27% of consumers as thin file – or having a limited credit history

- 71.3% of consumer as thick file – or having sufficient credit history

- 1.7% of consumers as “unscoreable”

Infographic: Distribution of Total U.S. Population by Credit Worthiness

By employing alternative data, lenders can move 11.4 million consumers from “unscoreable” and thin file segments to the thick file segment. This is due to the additional trade lines available from alternative data. Additionally, 50 million thin file consumers have supplementary trade lines even though they don’t move to thick file status. With all the options now available to lenders, they are now asking which alternative data is best for them.

For more information on the topics discussed at the 2019 Spark conference,